Dental Payment Plans UK: Your Guide to dental payment plans uk

Dental payment plans are simply a way to spread the cost of your treatment over a period of time, usually in monthly instalments. Think of it like financing a car, but for your smile.

They're particularly helpful for private dental work that isn't covered by the NHS. This could be anything from cosmetic treatments and teeth straightening to unexpected emergency procedures. Instead of facing one large, daunting bill, you can break it down into manageable chunks.

The Real Cost of a Healthy Smile in the UK

Let's be honest, figuring out dental costs in the UK can be a real headache. You've got long NHS waiting lists on one hand and private practice fees that can feel a bit mysterious on the other. It's no wonder so many people feel like the care they need is just financially out of reach.

This worry about cost stops people from doing everything from getting a routine check-up to finally getting that cosmetic work they've dreamed of.

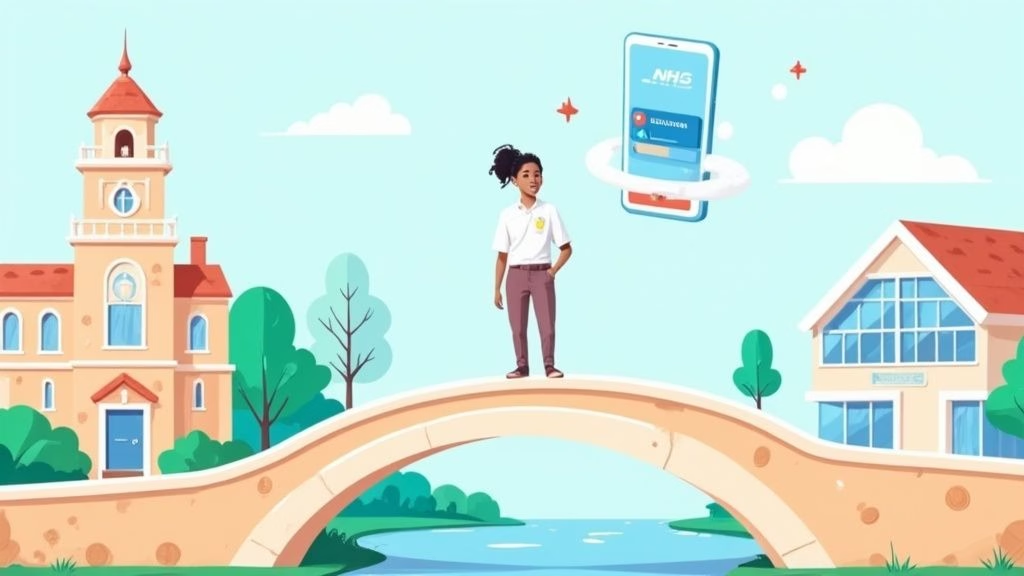

It’s this financial hurdle that has made dental payment plans UK a go-to solution for so many. These plans essentially act as a financial bridge, getting you the high-quality care you need, when you need it, without the pressure of paying for it all at once.

Why Payment Plans Are Becoming Essential

The truth is, more and more people are looking for flexible ways to pay for their dental care, and a big part of that is down to the difficulties in getting an NHS appointment. While things have gotten a little better recently, where you live still makes a huge difference.

New data shows that while 78% of people across the country managed to get an NHS appointment when they tried, that number fell to just 69% in the South West. On top of that, almost a third of people looking for a new dentist were told the practice simply wasn't taking on any new NHS patients. These access problems inevitably steer more people towards private care, where payment plans become a vital tool.

This is where modern solutions like Toothfairy are really shaking things up.

At Toothfairy, we don’t think money should ever get in the way of your health. Our app is built to cut through all that confusion and give you a smarter, more affordable way to invest in your smile without the usual financial stress.

Of course, before you jump into any plan, it’s a good idea to have your own finances in order. A great starting point is building an emergency fund, which gives you a solid safety net for any unexpected costs, dental or otherwise.

In the end, whether you’re thinking about clear aligners, need urgent help for a toothache, or are planning a smile makeover, getting to grips with your payment options is the first step to making it happen.

Decoding Your Dental Finance Options

Figuring out how to pay for dental treatment can feel like trying to read a map in a foreign language. With acronyms like APR and terms like "credit checks" flying around, it’s easy to get overwhelmed. Let's clear the fog and break down each option, so you can confidently pick the right path for you.

First up, you have the two main routes for dental care in the UK: NHS and private. NHS treatment is sorted into fixed payment bands for specific procedures. The catch? These bands rarely cover cosmetic work like teeth whitening or clear aligners. Plus, as many of us have discovered, just getting an NHS appointment can be a challenge, which often makes private care the only realistic choice.

This is where getting to grips with private dental payment plans in the UK is so important.

Breaking Down Private Dental Plans

Once you step into the world of private dentistry, a few different ways to manage the cost open up. Each one is designed for different needs and financial circumstances.

-

Clinic Membership Plans: Think of this like a subscription service for your smile. You pay a set amount each month, which usually covers your routine check-ups and hygiene visits. Members often get a handy discount on other treatments, too. It’s a great way to stay on top of your oral health and catch small problems before they become big ones.

-

In-House Finance: Some dental practices offer their own payment plans directly. This can feel simpler because you’re dealing directly with the clinic, but the terms can be wildly different from one place to the next. It pays to read the small print.

-

Third-Party Credit: This is probably the most common route. Your dentist will have a partnership with a separate finance company that provides a loan for your treatment. You’ll often see tempting 0% interest deals advertised, which makes this a very popular option for spreading the cost of bigger treatments.

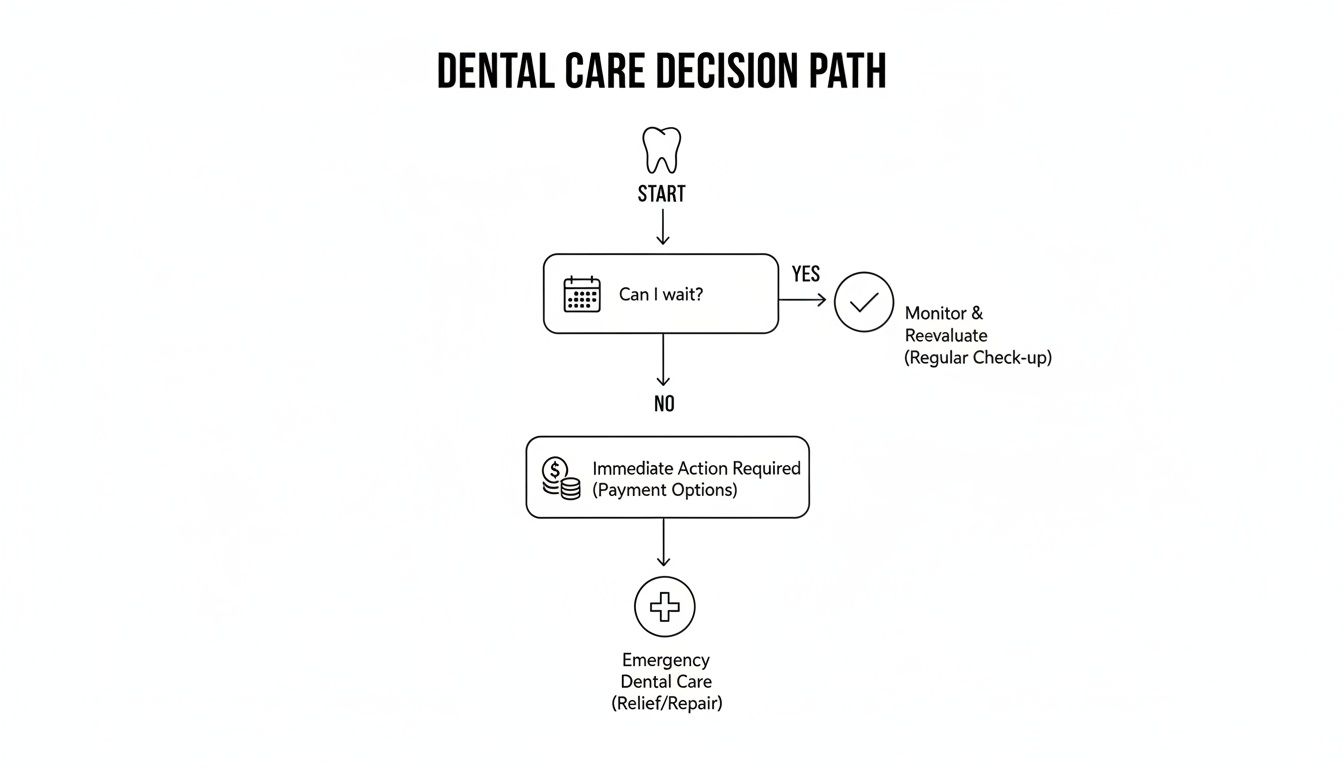

When a dental problem pops up unexpectedly, it helps to have a clear idea of your next steps. The flowchart below shows a typical thought process when you're faced with a decision about your dental care.

As you can see, when treatment becomes a necessity, a payment plan is often the most sensible and immediate solution.

Understanding 0% Finance and Credit

That 0% finance offer might sound too good to be true, but it's a legitimate way to spread costs. Essentially, it’s a loan. The finance company pays your dentist in full, and you pay the finance company back in manageable, interest-free chunks. To get one, you'll almost certainly need to pass a credit check.

A credit check isn't as scary as it sounds. It's just how a lender gets a snapshot of your financial history to see how you've handled credit in the past. This helps them decide if you're a good candidate for the loan.

While these plans are fantastic, they do come with strict rules. If you miss a payment, you could suddenly find high-interest rates applied to the rest of what you owe, which can get expensive fast.

As you weigh up your options, it's smart to think about your overall financial health. If you use credit for other things, for example, comparing credit card options can help you manage your money more effectively.

Ultimately, the aim is to find a way to get the treatment you need—whether it’s for a painful emergency or a confidence-boosting cosmetic fix—without causing yourself financial stress. This is where modern providers like Toothfairy are making a real difference, offering straightforward, easy-to-manage plans for treatments like teeth straightening, creating a smarter, more affordable way to straighten teeth than some high-cost aligner brands.

How to Apply for a Dental Payment Plan

So, you're ready to get started with your treatment? Good news. Applying for a dental payment plan here in the UK has become a pretty straightforward affair, especially now that modern tech is finally cutting through all that old-school paperwork.

Let's walk through the usual steps. That way, you’ll know exactly what to expect on the road to a healthier, happier smile.

Everything kicks off with the initial consultation. This is your chance to sit down with your dentist and chat about what you want to achieve, whether it’s sorting out an emergency, brightening your teeth, or finally getting started with clear aligners. Once you’ve agreed on a treatment plan and have a final quote, it’s time to talk finance.

The Application Journey Step-by-Step

Most private dental practices work with specialised third-party finance companies to handle their payment plans. The application itself is usually a simple online form you can fill out right there in the clinic or even later from your sofa at home.

- Initial Consultation: First up, your dentist works out exactly what you need and puts together a personal treatment plan. This gives you the total cost that the plan will need to cover.

- Completing the Application: You’ll be asked to fill in a form with your personal details, address history, and some employment information. It only takes a few minutes.

- The Credit Check: The finance provider will then run a credit check to see if you’re eligible. This is a totally standard part of the process for any kind of finance in the UK.

- Receiving a Decision: Thanks to modern systems, you often get a decision almost instantly—sometimes in just a couple of minutes.

- Signing the Agreement: Once you’re approved, you simply sign the agreement digitally, and you're all set to book your treatment.

Remember, a credit check is just the lender's way of getting a snapshot of your financial history. A steady income and a solid track record of paying your bills on time will give you the best possible chance of being approved.

A Smarter Way to Get Approved

The traditional route can sometimes feel a bit clunky, with physical paperwork and a nervous wait for the decision. This is where platforms like Toothfairy are really shaking things up. By bringing the entire process into one simple app, we’ve made applying for finance quicker and much more transparent.

This all-in-one approach is a massive plus for treatments like teeth straightening. While some aligner brands can force you into separate consultations and drawn-out finance applications, Toothfairy keeps it all in one place. You can get your quote, apply for a dental payment plan, and get a fast decision, all from your phone.

It’s not just about saving you time; it's about making that smile you've always wanted feel achievable and stress-free. The focus is back where it should be: on your treatment, not on the paperwork.

Financing Your Dream Smile Makeover

That smile makeover you’ve been dreaming of – whether it’s veneers, professional whitening, or clear aligners – can be an incredible confidence booster. The catch? These kinds of cosmetic treatments aren’t covered by the NHS, and paying for them all at once can be a real stumbling block for most of us.

This is where dental payment plans in the UK come into play. They’re not just a handy option; for many, they're the only way to make a dream smile a reality. By breaking down a large, intimidating bill into manageable monthly payments, you can get started on your treatment right away instead of putting it off for years.

The demand for private dental care is skyrocketing. The UK market is on track to reach a staggering £8.3 billion by 2025, and it’s no wonder why. A recent survey found that a massive 82.8% of English dental surgeries aren't taking on new adult NHS patients. This big shift towards private care highlights just how crucial flexible payment options are, a trend you can read more about in these market insights about the UK dental industry.

Aligners: Comparing Payment Models

Teeth straightening is one of the most sought-after cosmetic treatments out there, but how you pay can vary wildly from one provider to the next. The old-school, traditional model often comes with a hefty price tag.

So, what are you actually paying for? The costs quickly add up:

- Multiple In-Person Appointments: Every single check-up and adjustment adds to the final bill.

- Clinic Overheads: The high costs of running a physical practice—rent, staff salaries, expensive equipment—get passed straight on to the patient.

- Branding and Marketing: Those big ad campaigns for certain aligner brands? That budget is baked into the price of your treatment.

This approach can make straightening your teeth feel like a luxury reserved for the few. It often involves clunky, separate financing processes that feel disconnected from your actual dental care.

Luckily, times are changing. Modern providers are using technology to sidestep these old inefficiencies, making the whole experience simpler and, more importantly, much more affordable for you.

The Toothfairy Approach: A Smarter, More Affordable Way

Here at Toothfairy, we just don't think getting a straighter smile should be so complicated or expensive. We’ve built our entire model around smart technology to cut out all those unnecessary costs, which means our dental payment plans are far more accessible.

So, how do we make it work? We’ve streamlined the whole process. You manage your treatment through our straightforward app, which drastically cuts down on the need for endless clinic visits and lowers our overheads. We then pass those savings directly on to you.

It's that simple. You get the exact same high-quality, dentist-prescribed clear aligners, just without the inflated price tag. With a flexible and transparent payment plan from Toothfairy, that perfect smile is finally within your reach.

Right, let's look beyond the glossy brochures and get down to what really matters when you're considering a dental payment plan. Signing any financial agreement can feel a bit daunting, but it doesn't have to be. A little bit of know-how goes a long way in making sure the plan you pick is a genuine help, not a headache waiting to happen.

The single most important number to find in any agreement is the ‘total amount payable’. Forget the promotional rates for a moment; this figure is the bottom line. It shows you the full cost of your treatment plus every penny of interest and any fees over the life of the loan. This is the only way to make a true like-for-like comparison between different finance options.

Spotting the Red Flags

When you’re reading through the details, a few things should set your alarm bells ringing. Catching them early can save you a world of stress and a surprising amount of money.

- Sneaky Fees: Keep an eye out for vague language like 'admin fees' or 'setup charges' that weren't discussed upfront. Any reputable provider will have a clear, itemised list of all costs.

- The 0% APR Trap: That tempting 0% interest offer can have a nasty sting in its tail. Some deals state that if you miss even one payment, or don't clear the balance within the promotional period, a much higher interest rate gets applied to the entire original loan, right from day one.

- Rigid and Unforgiving Terms: We all know life can throw a curveball. A good plan should have some built-in flexibility. Be very cautious of agreements with steep penalties for paying the loan off early or that offer zero wiggle room if your circumstances change.

Ultimately, you want a plan that fits your life. At Toothfairy, we've built our payment options to be the antidote to the often confusing and complex financial products out there. Our approach is simple: clear, upfront pricing with no nasty surprises.

Your Pre-Signature Checklist

Before you put pen to paper (or click 'accept'), have a direct conversation with the finance company or your dental practice. Don't ever feel shy about asking questions until you're 100% clear on everything.

- What is the final, total amount I will pay back, including everything?

- Are there any fees for setting up the plan?

- What are the exact consequences if I miss a payment?

- Can I settle the plan early without being penalised for it?

- Will the interest rate stay the same for the whole term?

Getting straight answers to these five questions is non-negotiable. It means you're making a choice with your eyes wide open. A good provider will welcome the questions and be happy to walk you through every detail, ensuring your path to a healthier smile starts with confidence, not confusion.

The Toothfairy Advantage: A Modern Way to Pay

After wading through all the options for traditional dental finance, you might be left feeling a bit overwhelmed. It's often a world of confusing paperwork, hidden fees, and rigid plans that don't quite fit your life. Let’s be honest, the old way of doing things often adds more stress to an already stressful situation.

That’s exactly why we built Toothfairy. We saw the common frustrations and decided to create a smarter, more affordable way to get the dental care you need, whether that's teeth straightening, cosmetic work, or emergency treatment.

Forget piles of paperwork and long waiting periods. We’ve moved the entire process onto a simple, easy-to-use app. This isn't just about making things quicker; it means we can cut out a lot of the usual administrative costs. The result? We can offer treatments like clear aligners at a genuinely affordable price, especially when you compare us to other well-known aligner brands.

Smarter Finance for Your Smile

Our whole approach is built on two things: making high-quality dental care accessible and being completely transparent about the cost. Whether you need an emergency fix or are planning a full smile makeover, every Toothfairy payment plan is clear and flexible. Plus, you get access to our hand-picked network of excellent dentists, so you know you’re in good hands.

It’s a different world from the constraints of public services. The NHS has a dental budget of around £4 billion, which sounds like a lot, but ongoing reforms and a real shortage of appointments mean that going private is often the only way to get timely or cosmetic treatment. You can read more about the latest NHS dental reforms to get a feel for the current situation.

Toothfairy offers a clear path forward. We believe that paying for the dental care you need shouldn't be a constant battle. Our model is a direct, affordable, and stress-free way to invest in your oral health.

We’ve worked hard to break down the barriers that used to make cosmetic and even emergency dental work feel out of reach for so many. With the app, you can browse treatments, put together a plan that works for you, and see exactly how achievable your dream smile really is.

Ready to see how it works? The first step couldn't be simpler. Download the Toothfairy app today, explore your options, and build a plan that fits your life and your budget. Your ideal smile is closer than you think, without all the financial worry.

Frequently Asked Questions

It’s completely normal to have a few questions when you’re looking into spreading the cost of dental care. To help clear things up, here are some straightforward answers to the queries we hear most often.

Can I Get a Dental Payment Plan with Bad Credit?

Yes, you often can. While it’s true that many of the big 0% finance providers look for a strong credit history, they aren't the only game in town. Some specialist lenders and even in-house plans offered directly by clinics are set up for people with a less-than-perfect credit score. The trade-off is that you might face a higher interest rate.

At Toothfairy, we look at every situation on a case-by-case basis, focusing more on what’s affordable for you right now. It never hurts to check, especially since many providers use an initial ‘soft search’ that won’t leave a mark on your credit file.

Are Dental Payment Plans Worth It for Minor Treatments?

This really boils down to your personal finances. If you’re looking at a small, one-off cost that you can comfortably cover, paying upfront is probably the easiest way to go.

But for treatments like professional teeth whitening, a payment plan can be a brilliant way to make it feel much more manageable. It means you don't have to raid your savings or put it off. The whole point is to access the care you need without the financial stress, so if spreading the cost of a smaller treatment helps you do that, it’s absolutely worth considering.

What Happens If I Miss a Payment on My Dental Plan?

The consequences of a missed payment really depend on your specific agreement. With a 0% finance deal, you might face a late fee. The bigger risk, though, is that the provider could withdraw the interest-free offer altogether, which means you'd suddenly start paying high interest on the rest of your balance.

The most important thing is to be proactive. If you think you’re going to struggle to make a payment, get in touch with your finance provider or the dental clinic straight away. They’d much rather work with you to figure something out, like a new payment schedule, than let things spiral.

Ready to find a smarter, more affordable way to get the smile you’ve always wanted? With Toothfairy, you can browse treatments, get a transparent quote, and apply for a flexible payment plan, all from our easy-to-use app. Download it today and take the first step towards a healthier, more confident you. Find out more at https://www.toothfairyapp.co.uk.

Last updated on December 17, 2025

Dr. Deepak

ToothFairy Care Team.

Dr. Deepak

ToothFairy Care Team.