Will Insurance Cover My Clear Aligner Treatment?

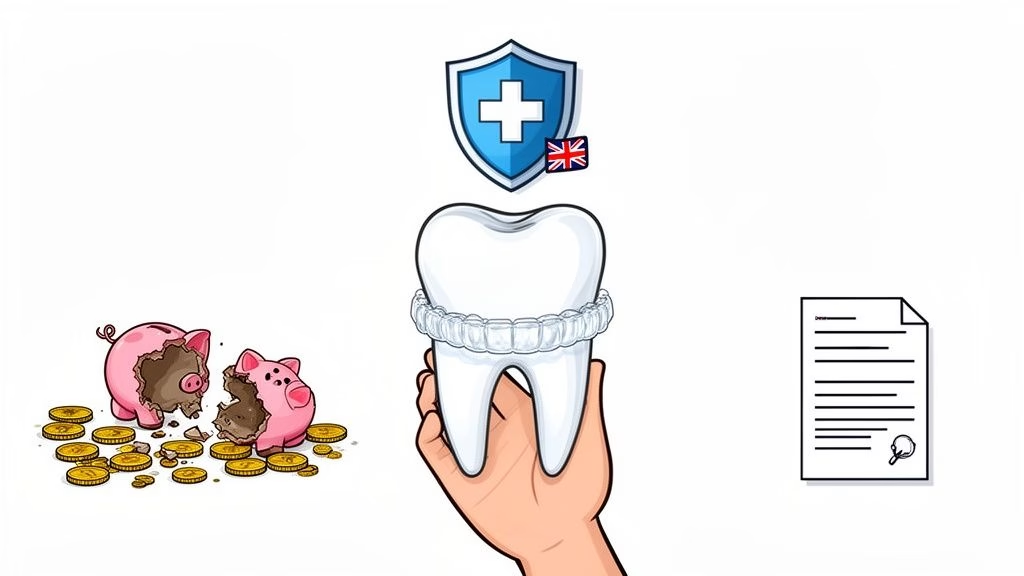

Let's cut straight to it: finding a standard dental insurance plan in the UK that covers big-name clear aligner brands is a bit like searching for a needle in a haystack. Most insurers file this kind of orthodontic work under 'cosmetic', which means it falls outside the scope of what they’re set up to pay for. It helps to think of your policy as a safety net for your dental health, not a fund for aesthetic enhancements.

The Short Answer on Insurance and Clear Aligners

So many of us hope our insurance will take the sting out of the cost of straightening our teeth. But the reality on the ground is often quite different. The system, both public and private, is built around rules that frequently leave adult cosmetic orthodontics out in the cold, meaning the full cost lands squarely on your shoulders.

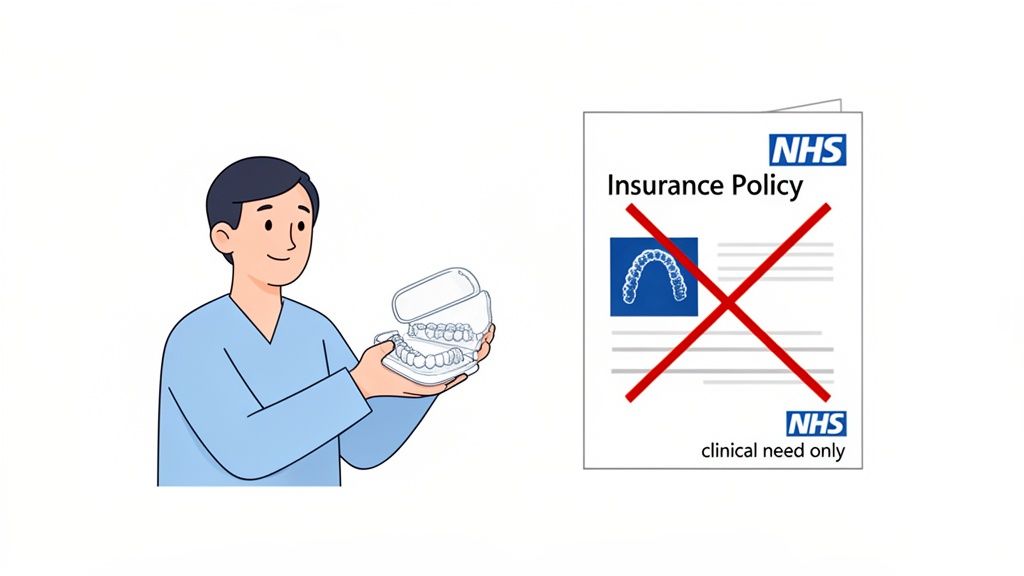

This is particularly true when you look at the NHS. Its funding is channelled towards children and young people under 18 who have a clear and pressing clinical need for treatment. For adults simply wanting to improve their smile, the NHS door is usually closed. And even when treatment is approved for younger patients, it’s almost always for traditional fixed metal braces.

Private Insurance and Its Limitations

You might think private dental insurance would be more flexible, but it often operates on a similar wavelength. While some top-tier plans might boast an "orthodontic benefit," you'll quickly run into some pretty significant catches:

- Strict Age Limits: Coverage is very often capped at 18 or 19 years old. If you're an adult, you're likely out of luck.

- Cosmetic Exclusions: The policy wording is usually crystal clear—treatments for purely aesthetic reasons are not covered.

- Lifetime Maximums: Even on the rare occasion a plan does offer some orthodontic cover, it will come with a lifetime cap. A typical limit might be £1,000 or £1,500, which is just a fraction of the total cost of treatment with a specific aligner brand.

To help you get a quick overview, here’s a simple breakdown of what to expect from different providers in the UK.

UK Clear Aligner Insurance Coverage at a Glance

| Provider Type | Typical Coverage for Adult Cosmetic Aligners | Key Consideration |

|---|---|---|

| NHS | Effectively zero | Reserved for under-18s with a high clinical need, typically using metal braces. |

| Standard Private | Very rare to none | Most plans explicitly exclude cosmetic orthodontics for adults. |

| Premium Private | Limited, partial coverage at best | Might offer a small contribution, but always check for age limits and lifetime caps. |

As you can see, the path to getting your treatment covered through traditional channels is a tricky one, and for most, it leads to a dead end.

The bottom line is that for most adults in the UK, straightening your teeth with a specific aligner brand is overwhelmingly a private, self-funded treatment. It’s not routinely offered by the NHS, and the vast majority of insurance policies simply don't include cosmetic orthodontic care.

The Reality of Self-Funding

With these hurdles in place, most adults need to be prepared to pay for their new smile out of their own pocket. Recent market analysis in the UK shows the average cost for a full treatment with a particular aligner brand is between £3,000–£3,300. This can swing from around £1,500 for minor tweaks to over £5,500 for more complex cases. If you want to dive deeper, you can learn more about the UK aligner market and what to expect financially.

This is why it’s so important to look beyond insurance. Instead of getting tangled up in policy documents for little to no reward, modern alternatives like Toothfairy offer a far more direct and affordable route, putting a confident smile within reach without the usual financial roadblocks.

Decoding Your Dental Insurance Policy

Let's be honest, trying to make sense of a dental insurance policy can feel like you're deciphering an ancient text. It's packed with jargon and clauses that seem designed to confuse. But think of it like a mobile phone contract – you've got a basic allowance, maybe some optional add-ons, and a whole lot of fine print that explains what you're actually getting.

Getting a handle on this language is the first step. Once you can speak their language, you can figure out whether your plan will actually chip in for your clear aligner treatment and avoid any nasty surprises down the line.

Key Terms You Need to Know

When you flick through your policy documents, a few key phrases will keep popping up in the orthodontics section. Let’s break down what they mean in plain English, so you know exactly what to look for.

-

Orthodontic Benefits: This is the magic phrase. It’s the specific part of your plan that covers teeth straightening. First things first, check if your policy even has this, as many standard plans skip it entirely. If it’s there, this is where you’ll find all the details on braces, aligners, and what your insurer is willing to cover.

-

Annual or Lifetime Maximum: This number is the hard limit on what your insurer will pay out for your orthodontic work. For example, if your policy has a £1,500 lifetime maximum, that's the absolute most they will contribute. Once you hit that cap, the rest of the bill is on you.

-

Waiting Periods: This is a classic catch. A waiting period is a chunk of time you have to be paying for the policy before you can actually use certain benefits. It’s very common for orthodontic coverage to come with a 6 to 12-month waiting period, meaning you can't just sign up today and start treatment tomorrow.

Think of your policy's fine print as the rulebook for a game. If you don't know the rules around waiting periods or coverage limits, you could end up paying far more than you expected.

Spotting Common Exclusions

Knowing what isn't covered is just as important as knowing what is. Insurers are masters of the fine print, and the exclusions section is where many people get tripped up. Keep an eye out for these.

A big one to look for is "cosmetic exclusions". Most insurance providers draw a very clear line between treatment that’s medically necessary and work that’s purely for looks. If you’re just looking to straighten a few slightly crooked front teeth, they will almost certainly classify that as cosmetic and refuse to cover it.

Also, pay very close attention to "age limits". A lot of policies that offer orthodontic cover only extend it to children or dependents, often cutting off at age 19. If you're an adult wanting to straighten your smile, this single clause could make your plan's orthodontic benefit completely useless, no matter how good it looks on paper. Knowing this stuff upfront helps you ask the right questions and plan your budget properly.

What About NHS Orthodontics for Adults?

Many of us in the UK wonder if the NHS might foot the bill for teeth straightening. It’s a common question, but the answer is, unfortunately, almost always no for adults. The NHS has a very specific, needs-based system for orthodontics, and its limited budget is funnelled towards those with the most pressing clinical needs.

If you’re an adult hoping to fix a few crooked teeth for a confidence boost, the NHS route is likely a dead end. Funding is overwhelmingly reserved for patients under the age of 18, and even then, it's only for significant dental health problems. Think severe overcrowding that impacts jaw function, not minor cosmetic tweaks. The system is there to prevent long-term health complications, not to create perfect smiles.

How the NHS Decides: The IOTN Score

So, how does the NHS make these decisions fairly? They use a standardised grading system called the Index of Orthodontic Treatment Need (IOTN). It’s the official yardstick that determines who gets access to funded treatment.

A specially trained dentist or orthodontist will assess your teeth against this index, which has two parts:

- The Dental Health Component: This grades your teeth on a scale from 1 (nearly perfect) to 5 (very severe issues). To even be considered for NHS treatment, you typically need to score a Grade 4 or Grade 5.

- The Aesthetic Component: This is a bit more subjective. Your smile is compared against 10 standard photos to judge how much the alignment affects your appearance.

The bottom line is this: unless your teeth are crooked enough to cause genuine, long-term health problems, you won't qualify. The mild to moderate crowding that most adults want to correct simply doesn't make the cut.

This strict focus on clinical need is precisely why private treatment has become the go-to for most adults. Even if, by some small chance, an adult did qualify for NHS care, the treatment offered would be traditional metal braces, not expensive clear aligners from a specific brand. It’s a system designed for function, not aesthetics, which is where modern, accessible solutions like Toothfairy step in to fill a very real gap.

Confirming Your Coverage: A Step-by-Step Guide

Trying to figure out your insurance policy can feel like you're lost in a maze. But when you need to know if your plan will foot part of the bill for your aligners, there’s a straightforward path to getting a clear answer. Instead of crossing your fingers and hoping for the best, following a few simple steps will get you a definitive 'yes' or 'no' in writing.

This way, you can ditch the guesswork and plan your finances with real confidence, knowing there won't be any nasty surprises down the line.

1. Locate the Right Policy Documents

First things first: you need to play detective. Dig out the most recent copy of your dental insurance policy booklet or, even easier, log in to your provider’s online portal. Your target is the section specifically labelled “Orthodontic Benefits”.

Keep a sharp eye out for any mention of age limits, waiting periods, and lifetime maximums. Getting a handle on these details gives you a solid starting point before you even think about picking up the phone.

2. Call Your Insurer with Prepared Questions

With your policy details in front of you, it’s time to call your insurer. The trick here is to go in prepared. Having a list of specific questions ready means you’ll get all the answers you need in one efficient conversation.

Here are the essential questions to have on your list:

- Does my plan actually include orthodontic benefits for adults?

- Is treatment with clear aligners covered, or is coverage limited to traditional metal braces?

- What is my lifetime maximum for orthodontic treatment, and how much of it have I got left?

- Is there a waiting period I need to get through before I can make a claim?

- Do I need to get pre-authorisation from you before my treatment starts?

A short, focused call like this can save you months of confusion and frustration.

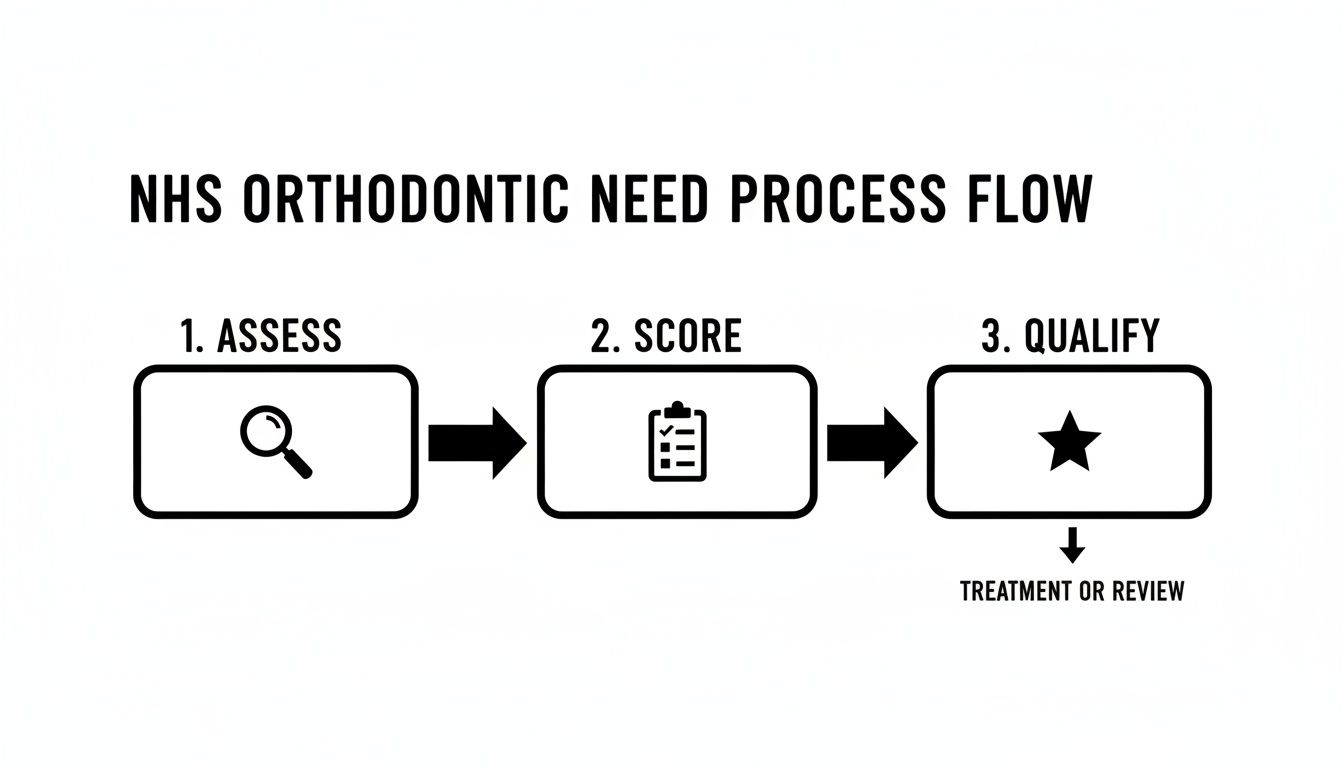

When it comes to public funding, like the NHS, the process is even more structured. Eligibility is determined through a strict assessment and scoring system based on clinical need.

This flowchart shows that journey, from the initial assessment right through to qualification. If you want to get more into the weeds of checking your private policy, have a look at these practical tips for verifying your insurance coverage.

3. Get a Detailed Treatment Plan

Your next move is to get a formal treatment plan from your dentist. This is the document that outlines why you need treatment, how long it’s expected to take, and—crucially—the total cost. This isn’t just a simple quote; it’s a professional recommendation that your insurer needs to see.

A detailed treatment plan from a qualified dentist is your most powerful tool. It transforms your request from a vague query into a specific, documented case for your insurer to review.

4. Submit a Pre-Authorisation Request

Finally, with that treatment plan in your hands, either you or your dental practice can submit a pre-authorisation request (sometimes called a pre-determination) to your insurer. This is the most important step. You're officially asking them to review your case and confirm in writing exactly what they will cover before you commit to anything.

Their written response is the official answer you've been looking for. It will state the exact amount they agree to pay, leaving no room for doubt. This gives you the financial clarity to decide what's next, whether that's moving ahead with insurance or exploring more direct and affordable routes like Toothfairy, which sidestep these hurdles altogether.

Calculating the Real Cost of Your New Smile

When you start exploring teeth straightening, the price tags can be a bit of a shock. Even if you have a pretty good dental insurance plan, what you actually pay out-of-pocket for a big-name aligner brand is often much higher than you might guess, leaving a hefty gap for you to cover.

Let's walk through a common, real-world example. Say you've been quoted £3,500 for your treatment. You dig into your insurance policy and find you have a lifetime orthodontic maximum of £1,000. That sounds like a decent contribution at first, but it still leaves you with a £2,500 bill to settle. This is the reality for many adults in the UK; insurance often only takes a small bite out of the total cost.

What Drives Up the Price Tag

That final quote isn't just a number plucked out of thin air. Several key factors push the price up, and understanding them makes it clear why the traditional route to a straighter smile can be so expensive.

- Complexity of Your Case: Correcting a few slightly misaligned front teeth is a much quicker and cheaper job than fixing complex bite issues or severe crowding. The more your teeth need to move, the more it's going to cost.

- Clinic Location: A swanky clinic in central London will naturally have higher overheads than a practice in the Midlands, and those costs—from rent to staffing—are reflected in your bill for the exact same treatment.

- Brand Name Markups: Opting for a heavily marketed, household-name aligner brand often means you’re paying a premium for the name itself.

This is the financial pinch where many people get stuck. The high upfront cost, coupled with what feels like a token gesture from insurance, can make a confident smile feel completely out of reach.

Recent UK market research pins the average cost for a specific aligner brand's treatment at around £3,200–£3,300. Prices can dip to £1,500 for very minor tweaks or soar past £5,500 for complex cases. If a typical insurance policy maxes out at £1,500, you’re still left paying £1,800 or more, usually through a finance plan. For a deeper dive, you can explore the pricing data from UK dental practices.

Here is a quick look at how those numbers might stack up in a typical scenario.

Sample Cost Breakdown Traditional Aligners with Insurance

This table illustrates what you might realistically expect to pay for treatment with a well-known aligner brand, even with a mid-tier insurance policy helping out.

| Cost Item | Typical Price | Amount Covered by Insurance (Example) | Your Final Cost |

|---|---|---|---|

| Initial Consultation & Scans | £250 | £50 (if covered as a check-up) | £200 |

| Total Aligner Treatment | £3,500 | £1,000 (Lifetime orthodontic maximum) | £2,500 |

| Retainers (post-treatment) | £300 | £0 (Often not covered) | £300 |

| Total Out-of-Pocket | £4,050 | £1,050 | £3,000 |

As you can see, the final bill is still substantial. This kind of transparent cost breakdown reveals the financial hurdles people face and really highlights the need for a smarter, more affordable way to straighten teeth—one that sidesteps the inflated costs of the traditional clinic model and gives you back control.

A More Affordable Path to a Straighter Smile with Toothfairy

Let's be honest: navigating the world of orthodontics, with its high costs and confusing insurance policies, can be a real headache. After seeing how much you might have to pay out-of-pocket for big-name aligners, it’s only natural to look for a smarter way forward. That’s exactly where Toothfairy comes in, offering a modern alternative built for real-world budgets and busy lives.

We've fundamentally re-thought how teeth straightening works, getting rid of the traditional barriers that make it so expensive. By connecting you directly with qualified UK dentists through our award-winning app, we eliminate most of the overheads that come with multiple, time-consuming clinic visits. This direct approach means you get professional, dentist-prescribed treatment without the hefty price tag.

How Toothfairy Makes the Difference

Our entire model is built on one simple idea: delivering safe, reliable results in a way that fits seamlessly into your life. We believe a confident smile shouldn't be a luxury, so we've focused on making professional care genuinely accessible.

Here’s how we pull it off:

- Virtual Consultations: You can connect with a dentist right from your sofa. This completely cuts out the travel time and costs of those initial assessment appointments.

- Dentist-Prescribed and Monitored: This is crucial. Every single treatment plan is created and personally overseen by a qualified dental professional, making sure your journey is both safe and effective from start to finish.

- A Direct-to-You Model: We've simplified the entire process, from supply chain to admin. By doing this, we can pass all those savings directly on to you.

Toothfairy was created to bridge the gap between eye-wateringly expensive cosmetic dental work and the care people actually need. We provide a direct, dentist-led path to a straighter smile that completely sidesteps the insurance maze and inflated clinic fees.

A Modern Solution for Employee Benefits

It’s not just about individual care. Toothfairy also offers a forward-thinking employee benefits programme. More and more companies are realising that standard dental insurance often misses the mark, especially for cosmetic treatments that can make a huge difference to an employee's confidence and wellbeing.

Our corporate plans are a fantastic perk that helps teams afford the dental care they truly want, from teeth straightening and whitening to gaining access to emergency dental care. For businesses, it’s a brilliant way to support their staff’s health, which can help reduce dental-related absences and foster a much more positive workplace culture.

Whether you're looking for yourself or exploring options through your employer, Toothfairy offers a clear path to achieving your dream smile—without the financial strain and complexity of older methods. It’s professional care, made simple and affordable.

Your Questions About Aligner Insurance Answered

Let's wrap things up by tackling some of the most common questions that pop up when people start looking into insurance for their teeth straightening journey. Getting straight answers here can make all the difference in your decision.

Can I Ever Get Clear Aligners on the NHS?

For an adult wanting to straighten their teeth for cosmetic reasons, the answer is almost always a firm no. NHS orthodontic funding is really geared towards under-18s who have a clear clinical need for treatment, which is assessed using a grading system known as the IOTN. Even for the kids who do qualify, the standard treatment is almost always traditional metal braces, not expensive clear aligners.

What Are Dental Cash Plans and Can They Help?

It's easy to mix these up with insurance, but they work quite differently. With a dental cash plan, you pay a set monthly amount, and in return, you can claim back cash for routine dental work like check-ups and hygienist appointments, but only up to a certain annual limit. While they're handy for everyday costs, their contribution towards a full orthodontic treatment costing thousands will be a drop in the ocean.

A common misconception is that all dental plans function the same way. For a broader perspective on what types of insurance cover dental needs, it's useful to explore common queries, such as understanding if dental coverage is included in insurance plans.

Are Some UK Insurers Better for Orthodontics?

Honestly, there isn't a single "best" insurer for this. While you might find a few top-tier corporate or private plans that offer a small orthodontic benefit for adults, they are the exception, not the rule. Everything hinges on the specific policy's terms and conditions—you have to dig into the fine print about cosmetic treatments, age limits, and any lifetime maximums.

Will My Employer's Dental Plan Cover This?

It's possible, but don't count on it. Many standard employer-provided dental plans come with the same cosmetic exclusions you'd find in a personal policy. The good news is that forward-thinking employers are starting to offer more flexible and modern benefit packages. This is where options like Toothfairy's employee benefit scheme come in, offering a much smarter and more direct way for companies to help their staff afford the treatments they actually want, bypassing the usual insurance roadblocks entirely.

Ready for a smarter, more affordable path to a straighter smile that doesn't rely on confusing insurance policies? Discover how Toothfairy provides dentist-prescribed clear aligners without the clinic markups. Learn more and get started today.

Last updated on December 25, 2025

Dr. Deepak

ToothFairy Care Team.

Dr. Deepak

ToothFairy Care Team.